Rajhnish Kumar, a 16-year-old teen from suburban India and an ardent cricket fan, has developed a habit that mirrors millions across the nation—betting on fantasy gaming apps. What began as harmless entertainment has transformed into a financial quagmire, reflecting a broader crisis that has forced India to take one of the world’s most stringent stances against online real-money gaming.

The Rise of a Digital Empire

In recent years, India’s online fantasy gaming market has exploded with unprecedented ferocity. With flashy advertisements endorsed by popular celebrities and sports personalities, platforms like Dream11, Mobile Premier League (MPL), and Gameskraft made real-money gaming look credible and aspirational, drawing youth into a digital ecosystem that promised wealth but delivered financial strain for most. The industry grew at a staggering 28% compound annual growth rate, reaching INR 16,428 crore by fiscal year 2023, with India’s online gaming market valued at $4.3 billion in 2024.

The numbers tell a seductive story: over 180 million users participated in fantasy sports across more than 300 platforms, with cricket accounting for 85% of revenue. During major events like the Indian Premier League (IPL), user engagement surged to 370 million. Dream11 alone boasted 260 million registered users, becoming India’s most valuable and profitable gaming unicorn with operational revenues of Rs 6,384 crore in fiscal year 2023.

The Dark Side of Digital Dreams

Behind the glamorous advertisements and celebrity endorsements lies a troubling reality. Gaming companies implemented internal policies that betrayed their own product’s fairness—several platforms prohibited their own employees and relatives from playing their apps, suggesting insider knowledge of algorithms that the common public believed were based purely on luck and strategy. This revelation exposes a fundamental inequity: those who built the systems knew something ordinary users didn’t.

The human cost has been devastating. Pradeep Kumar, 24, a postgraduate from Kanpur, has struggled with gambling addiction for two years, frequently taking loans to feed his habit. “On one occasion, he lost over 125,000 Indian rupees in a cricketing app that nearly destroyed him” his mother Ranjani told media outlets. In the southern state of Telangana, a family of three in Nizamabad took their lives after being unable to repay a loan of 3 million rupees racked up through online gambling.[source]

Research data reveals the extent of the problem: 12% of gamers engage in obsessive gaming behaviors, while 18% have suffered significant money losses. The psychological impact extends beyond finances—addiction to these platforms has become a mental health crisis affecting primarily young Indians between 18 and 35 years old, who constitute nearly 70% of Dream11’s user base.

How the World Handles Gaming

The Western Approach: Limited Intervention:

In the United States, developmental psychologist Douglas Gentile, Director of Research for the National Institute on Media and the Family, estimated that over 8.5 percent of children and teenagers—approximately 3 million Americans—exhibit multiple signs of gaming addiction. His landmark 2009 study found that pathological gamers spent twice as much time playing as non-pathological gamers and received poorer grades in school. Despite these findings, Western regulations remain limited to rating systems that evaluate content and maturity levels rather than addressing overuse.

European countries have adopted varied approaches. Malta and The United Kingdom maintain highly regulated markets with comprehensive licensing systems, while countries like France prohibit online casinos but permit sports betting and poker. Germany implemented partial legalization in 2021 with strict advertising and player protection rules.

Asia’s Aggressive Stance:

Taiwan has augmented its legal framework with amendments that explicitly criminalize online gambling, though operators increasingly use encrypted communications and cryptocurrencies to evade enforcement. In China, problematic video gaming has been recognized as a public health crisis, with 14 percent of Chinese adolescent internet users—about 10 million teenagers—meeting diagnostic criteria for internet addiction by 2007, increasing to 16 percent by 2018.

South Korea considers internet addiction one of the country’s most critical health issues, with internet usage in households rising to 85.1 percent by 2015. Both nations previously implemented government-monitored gaming hour limitations, though South Korea subsequently removed these restrictions in favour of youth freedom.

The Permissive Models:

New Zealand’s Gambling Act 2003 prohibits local operators from offering online casino games domestically but allows citizens to play on international casino websites. This creates a bifurcated system where local operators like TAB and Lotto NZ are restricted to sports betting and lottery products, while international platforms dominate the market for slots, table games, and live dealer experiences.

India’s Regulatory Journey

Tamil Nadu’s Early Warning:

Tamil Nadu emerged as India’s testing ground for gaming regulation. In April 2023, the state government enacted the Tamil Nadu Prohibition of Online Gambling and Regulation of Online Games Act, 2022, classifying online rummy and poker as “games of chance”. While the Madras High Court in November 2023 set aside the schedule including rummy and poker, emphasizing that states could regulate time limits and age restrictions but couldn’t ban skill-based games, Tamil Nadu’s approach remained more comprehensive than other states.

The state implemented stricter measures including Aadhaar-linked authentication, OTP verification, explicit prohibition of real-money games for those under 18, and proactive time limits with mandatory breaks. While states like Nagaland, Sikkim, and Goa implemented some gambling behavior limits, none matched Tamil Nadu’s rigor.

The Nuclear Option: India’s 2025 Ban

On August 21, 2025, Parliament passed the Promotion and Regulation of Online Gaming Bill, 2025, marking a landmark move to shield citizens from what the government characterized as the “menace of online money games”. The legislation was designed to curb addiction, financial ruin, and social distress caused by what authorities called “predatory gaming platforms that thrive on misleading promises of quick wealth”.

The ban is comprehensive and uncompromising. It prohibits all online money games—whether games of chance, skill, or hybrid formats. Advertising and promotion of such games is strictly forbidden, financial transactions related to these platforms cannot be processed by banks or payment systems, and authorities are empowered to block access to unlawful platforms under the Information Technology Act, 2000.

The Aftermath: An Industry in Ruins

The ban devastated India’s Rs 25,000 crore online gaming industry almost overnight. Dream11’s CEO Harsh Jain, in a candid interview with Moneycontrol, revealed the extent of the damage: “95 per cent of Dream11’s revenues have disappeared overnight, and 100 per cent of our profits“. Despite this catastrophic blow, Jain maintained an almost surreal composure, describing himself as “a delusional optimist” with a “two-year cash runway” to retain talent.

“I think the government has made it clear that they don’t want this right now. I don’t want to live in the past. We want to focus entirely on the future and not fight with the government on something that they don’t want” Jain stated, announcing that Dream Sports would not legally challenge the ban.

Bengaluru-based Gameskraft, founded in 2017 and once a poster child of India’s online gaming boom, suspended operations and laid off 120 employees. The company paused ‘Add Cash‘ and gameplay services on its rummy apps, including RummyCulture, while assuring users that account balances remained safe. Similarly, platforms like MPL, Zupee, and WinZo halted money-based operations in India.

Pivoting to Survival

Dream11 swiftly transitioned to a free-to-play model, allowing users to win brand-backed prizes through cost-free participation. Early advertisers included Swiggy, online astrology platform Astrotalk, and Tata Neu, seeking to connect with Dream11’s predominantly young user base. Harsh Jain indicated the company would focus on sports AI, fan engagement, and creator-led products.

WinZo wound up its real-money gaming business in India and entered the US market with micro-dramas, while Gurugram-based Zupee launched Zupee Studio, a short-format video platform. The industry-wide pivot represents a wholesale abandonment of business models that once generated billions in revenue.

The BCCI ended its partnership with Dream11, terminating a relationship spanning nearly a decade that was built on marketing budgets the company can no longer sustain. “We are going to all our partners and saying that we don’t have the ability to continue our marketing budget because the business doesn’t exist anymore,” Jain acknowledged.

The Unintended Consequences

Critics warn that the ban may drive users toward unregulated and offshore platforms where the Indian government has little control. This concern mirrors historical patterns where prohibition creates black markets rather than eliminating demand. Harsh Jain himself noted, “I think in any scenario, I think regulations would be the way to solve this problem. Because anything gives rise to a black market“.

The timing of the ban is particularly paradoxical. India’s online gaming market, currently valued at $4.3 billion, was projected to reach $15.2 billion by 2033 at a 15.2% compound annual growth rate. The sector showed potential to expand job opportunities to 250,000 by 2025. The ban eliminates not only an industry but also thousands of legitimate employment opportunities in an economy seeking growth engines.

Furthermore, the government’s previous imposition of 28% GST on online gaming deposits in 2023 had already driven some users toward illegal and offshore platforms. The complete ban may accelerate this migration, creating an enforcement nightmare where Indian citizens access gaming services beyond regulatory reach.

Where Is India Headed?

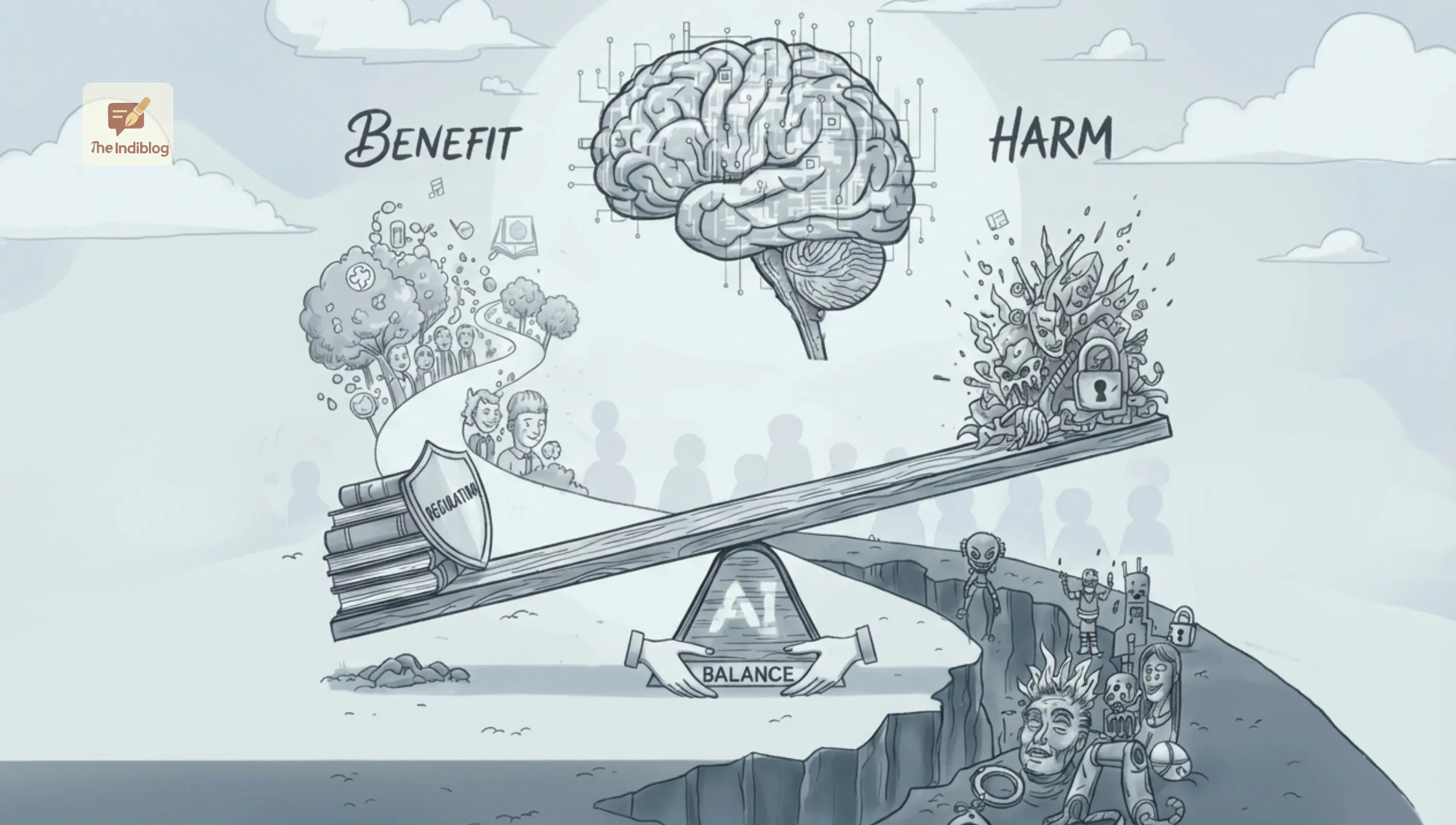

India now stands at a crossroads. The government has chosen prohibition over regulation, betting that eliminating legal avenues will solve the addiction and financial distress problems plaguing millions of young Indians. Yet the global experience suggests regulation—not prohibition—more effectively balances consumer protection with industry sustainability.

Will the government reconsider, as South Korea did, recognizing that overly restrictive approaches may ultimately prove counterproductive? For now, Rajhnish Kumar and millions like him face a choice: abandon their gaming habits or migrate to unregulated offshore platforms. The gaming companies, meanwhile, scramble to reinvent themselves in an uncertain regulatory landscape. India shows strict vigil as a Rs 25,000 crore industry evaporates, wondering whether the cure might prove worse than the disease.