Once the poster child of India’s low-cost aviation boom, IndiGo — commanding a remarkable 65% market share and operating nearly 2,000 daily flights — now finds its reliability and image under turbulence. What was once celebrated as India’s most punctual and dependable airline faces a credibility crisis, experts say.

The trouble began when the airline was forced to cancel over 5,000 flights following the enforcement of new mandatory rest laws for pilots. According to reports, IndiGo required 2,422 pilots to maintain its packed schedule but had only 2,357 available, leading to severe crew shortages and operational disruptions.

The Directorate General of Civil Aviation (DGCA) even issued a show-cause notice to IndiGo’s CEO, demanding an explanation for the flight chaos. In response, regulators ordered the airline to curtail 5% of its scheduled flights — a rare rebuke for an airline long considered an industry benchmark.

The Rise Of A Monopoly

IndiGo’s dominance in India’s aviation sector remains undisputed. With more than 100 million passengers flown annually and around 65% of the domestic market under its wings, the airline has, for all practical purposes, become a monopoly. But as economists often warn, monopolies breed indifference — and IndiGo seems to have tested the limits of public patience and government tolerance alike.

Over the past 15 years, India’s skies have seen several carriers crash and burn under debt or rising fuel and engine costs. Jet Airways, Kingfisher Airlines, and GoAir all fell victim to these challenges. IndiGo, however, seized the vacuum with remarkable speed — expanding across smaller cities and secondary routes where its signature blue-and-white jets became synonymous with accessible air travel.

Today, there are several non-stop routes where IndiGo reigns without competition. For instance (as on date of publishing), only IndiGo operates direct flights between Kolkata and Hyderabad or between Chennai and Coimbatore. Across India, there are as many as 606 such routes lacking alternatives. Any scale-back on these routes, therefore, risks disrupting connectivity and spiking fares — an outcome the government would be keen to avoid.

The damage, however, had already been done. Passenger frustration mounted as cancellations piled up, culminating in public backlash that dented IndiGo’s hard-earned reputation. In a bid to reclaim lost trust, the airline took out full-page advertisements in leading newspapers, offering a heartfelt apology under the banner “We are sorry”.

IndiGo’s Business Model: The Lean Machine

IndiGo’s ascent was built on a razor-sharp business model — efficient, frugal, and shrewdly managed. One of its core pillars was the sale-and-leaseback strategy. Back in 2005, co-founder Rakesh Gangwal struck a monumental deal with Airbus for 100 aircrafts. The sheer size of that order allowed IndiGo to secure aircraft at significantly lower prices than its competitors.

Once delivered, these planes were sold to leasing companies and leased back to IndiGo. The profit from the price difference generated immediate cash flow — which the airline reinvested into fleet expansion and new routes. This model gave IndiGo a steady pool of working capital and spared it from the heavy borrowing that had crippled rivals like Kingfisher and Jet Airways.

As aviation journalist Tarun Shukla documents in his book Sky High: The Untold Story of IndiGo, this strategic foresight catapulted the airline into an elite category — one that grew fast, stayed solvent, and became indispensable to India’s domestic skies. Yet today, the same airline that once perfected efficiency finds itself exposed to the very cracks it had long avoided — overdependence, overconfidence, and overreach.

India’s Everyday Duopolies

The aviation story is not an exception; it is a pattern. In sector after sector, India’s consumers increasingly toggle between two apps, two brands or two networks, while everyone else is reduced to background noise.

- In online food delivery, multiple studies place Zomato’s share in the 55–58 percent range by gross order value, with Swiggy around 42–45 percent, making the space a textbook duopoly despite rapid market growth.

- In telecom, Reliance Jio and Bharti Airtel together not only dominate mobile subscribers, they accounted for over 99 percent of new additions in mid-2025, cementing a two-player grip over incremental growth.

- On UPI, NPCI data for June 2025 show PhonePe with around 46–47 percent share and Google Pay with about 35–36 percent, together handling more than four-fifths of all transactions, with Paytm a distant third.

- In global carbonated beverages, Coca-Cola and PepsiCo together control the lion’s share worldwide; in India, estimates put Coca-Cola around 60 percent and PepsiCo near 30–34 percent of the carbonated drinks market, even as new challengers like Campa Cola nibble at the edges.

Even in ride-hailing, where new entrants are visible, the gravitational pull of two incumbents lingers. Market studies still describe Ola and Uber as the national backbone, even as Rapido eats into their share by capturing a large chunk of two-wheeler and a growing slice of four-wheeler rides.

The Quiet Tax On Consumers

India’s modern marketplace is caught in a paradox – neither fully competitive nor entirely monopolistic. Economists call this the “messy middle”: the duopoly zone where two dominant players keep the illusion of choice alive even as genuine competition fades.

In the early stages, such rivalry can be thrilling. When Jio stormed into telecom, or when food-delivery and ride-hailing apps battled for customers with discounts, consumers reaped the benefits. Access widened, habits shifted, and prices fell. But once markets mature, the rules change. When there are only two giants left standing, the goal moves from “winning the customer” to “stabilizing the market”. That’s when fares creep up in aviation, surge pricing becomes normal for cabs, and “platform fees” quietly appear on food apps – all explained away as higher input costs. Choice shrinks too. Restaurants can’t risk skipping either Swiggy or Zomato, just as users can’t abandon PhonePe or Google Pay without losing their network. Behind the abundance of icons on our screens hides a growing scarcity of real options.

The subtler cost is power – data power. When two platforms mediate most transactions, they hold troves of behavioural insight that can be used to self-preference, cross- subsidise, or snuff out emerging rivals long before markets even notice. The digital duopoly doesn’t break pricing rules; it quietly rewrites them.

The Legislative Lag

India’s competition law doesn’t punish dominance, only its abuse. Section 4 of the Competition Act, 2002, targets unfair pricing, limiting supply, and blocking access — but always after the fact. The Competition Commission of India has acted against digital giants for bundling or exclusionary conduct, yet these interventions are inherently reactive. By the time penalties arrive, markets have already tipped.

Recognising the lag, the government’s Committee on Digital Competition Law has proposed a new ex-ante Digital Competition Act to govern “systemically significant” enterprises before they foreclose markets. The National Payments Corporation of India’s slow, deferred cap on UPI market share — now pushed to 2026 — reveals the same hesitation: reform is promised, then delayed. Policymakers oscillate between celebrating scale as a national triumph and fearing what that scale might soon cost in lost contestability.

Designing A Better Duopoly

Some markets will always tend toward duopoly. Aircraft manufacturing, for instance, remains the preserve of Airbus and Boeing — an outcome dictated by high fixed costs, safety regulations, and global certification systems. Telecom, payments, and logistics share the same structural gravity: huge capital needs, network effects, and trust dependencies limit how many serious players can survive.

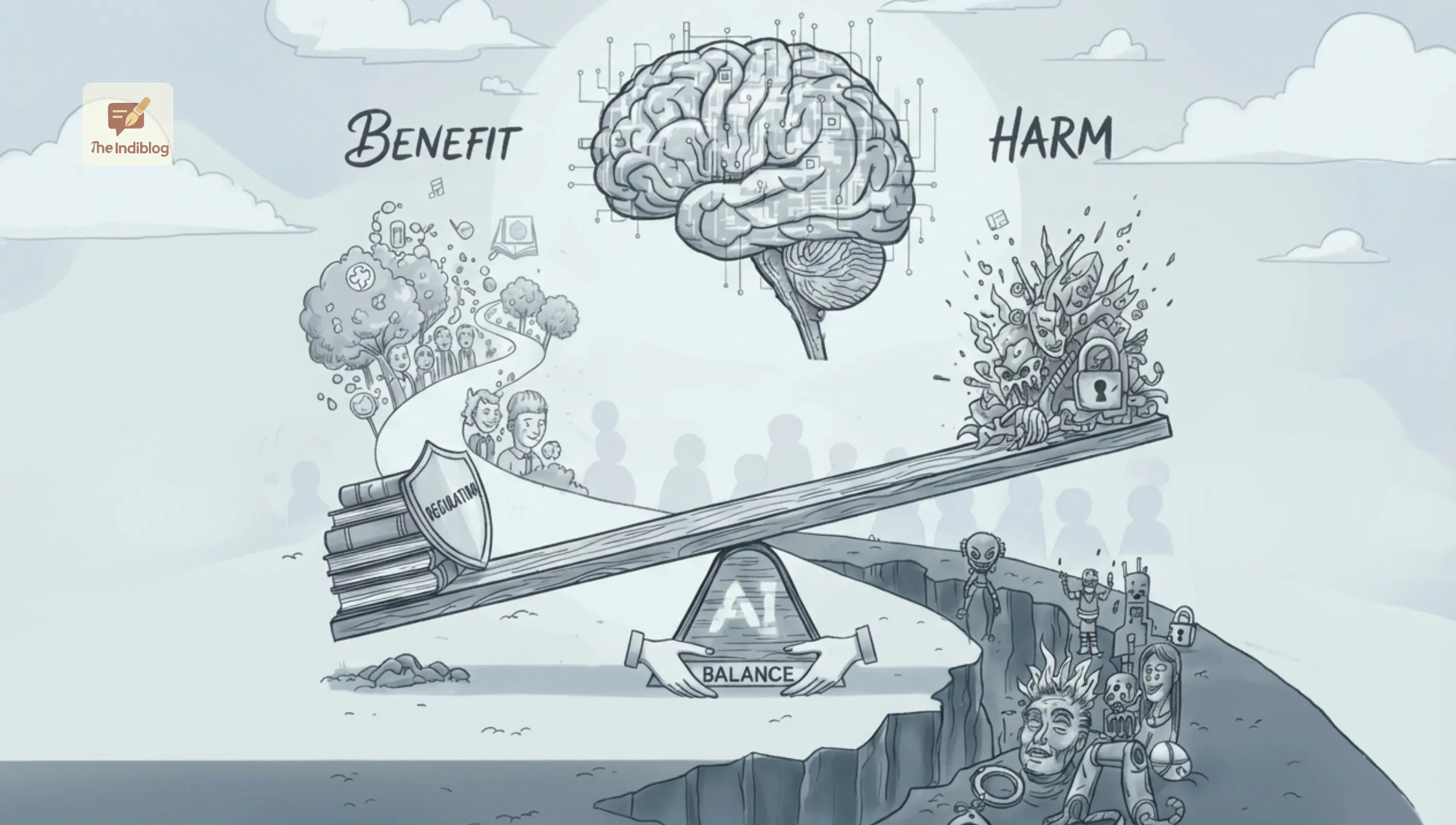

The real question, then, is not whether duopolies should exist but what kind democracies can tolerate. A good duopoly safeguards mobility — consumers can switch easily, smaller firms can still innovate in niches, and platforms play fair with data. A bad one locks users in, buries rivals under algorithmic bias, and taxes consumers through opaque fees. To keep markets healthy, India must move from policing abuse to setting ground rules upfront — interoperability mandates, transparent ranking systems, fair access clauses, and clear separation between gatekeepers and their own competing brands.

A Citizen’s Stake In Competition

Duopoly isn’t a boardroom abstraction. It touches everyday life — from the cost of a flight to the convenience of a tap-to-pay. When IndiGo cancels flights or an app revises fees overnight, the consequences ripple through families, not just stock tickers. For consumers, awareness is the first defence: if two brands dominate your spending category, it’s time to test alternatives. For policymakers, the harder task is proactive stewardship — to ensure that duopolies act as disciplined custodians of open markets, not gatekeepers of convenience.

Because in the end, when competition grounds to a halt, it isn’t just planes that stop moving — it’s the promise of a truly free economy.